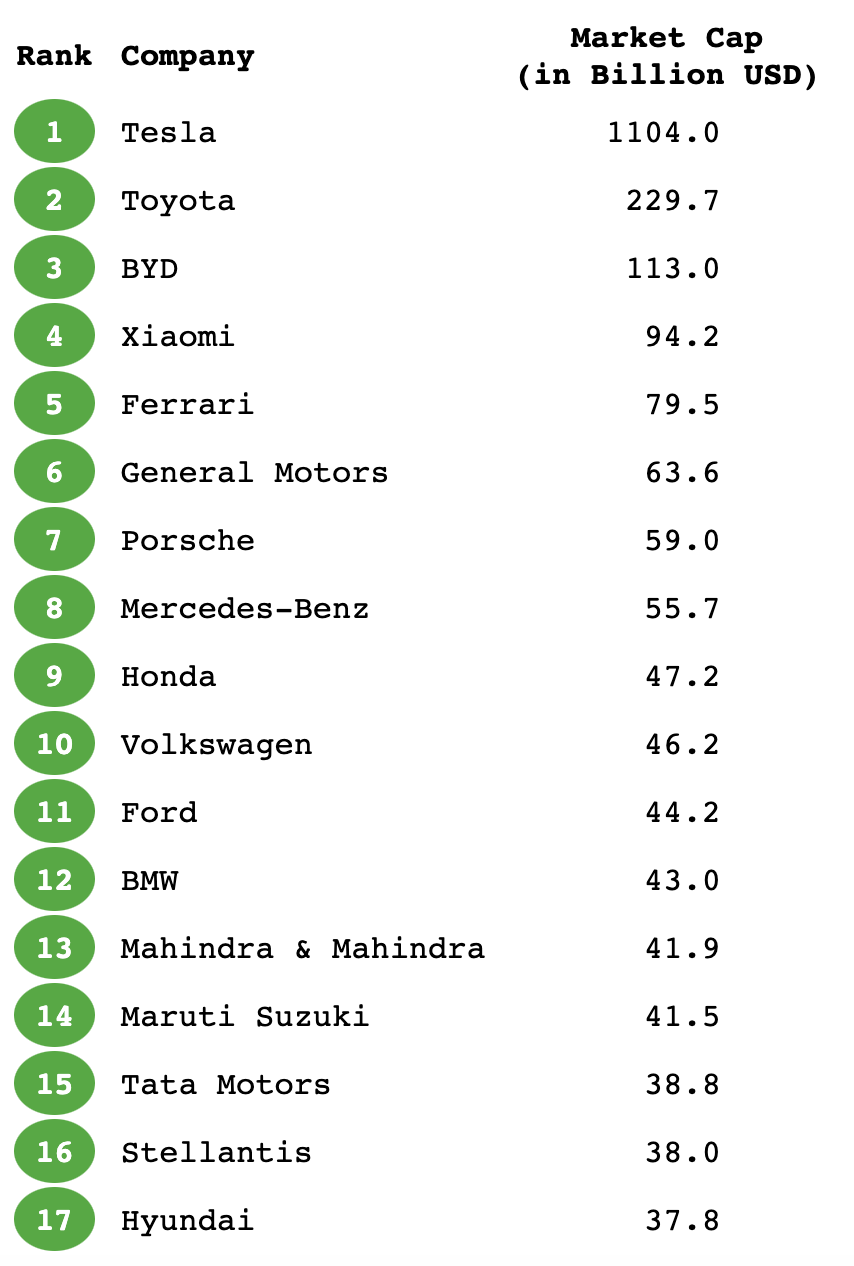

Chart of top automakers by market capitalization

Tesla’s recent post-election rally has cemented its position as the world’s most valuable automaker with a market capitalization now exceeding the combined worth of all other car manufacturers globally. At $1.1 trillion, Tesla’s valuation exceeds the $1.073 trillion combined total of the next 16 largest automakers. Contributing to this momentum was CEO Elon Musk’s recent involvement with the Trump campaign which helped fuel renewed investor interest. In just five trading sessions, Tesla’s stock climbed from $251 to over $350 a share.

Tesla’s valuation has always reflected high expectations for innovations not only in electric vehicles but also in areas like autonomous driving, energy storage, and artificial intelligence. This forward-looking vision has inspired a loyal following among both car owners and investors.

Under Musk’s leadership and entrepreneurial vision, Tesla has also been perceived as the market leader even though Toyota as the second-most valuable automaker sold 11.23 million vehicles worldwide in 2023 while Tesla sold only 1.81 million EVs.

Tesla’s next phase of growth is likely to revolve around artificial intelligence, both in autonomous driving technology and through its Dojo supercomputer. Should Tesla leverage these developments to enhance vehicle safety and performance, or even expand into other AI-focused ventures, it could unlock entirely new business opportunities.

Currently, Tesla shares trade at $328, up 30% since the start of the year.